What impact means to us

Impact is at the heart of what we do. We focus on three strategic objectives: to support productive, sustainable and inclusive development. We’ve developed a world-class impact management approach to help us do this.

Our approach to managing impact

We aim to maximise our impact through everything we do. This includes clearly setting out what we want to achieve, managing impact across the whole portfolio, and through every step of an investment. Our process starts when we’re deciding whether to make an investment, it continues as we monitor its progress, and finishes when we exit the investment responsibly. And through each investment, we are continually learning from what we do. This overall approach ensures that we meet the Operating Principles for Impact Management, the international standard for impact management, of which we are a founding signatory. Further information can be found here.

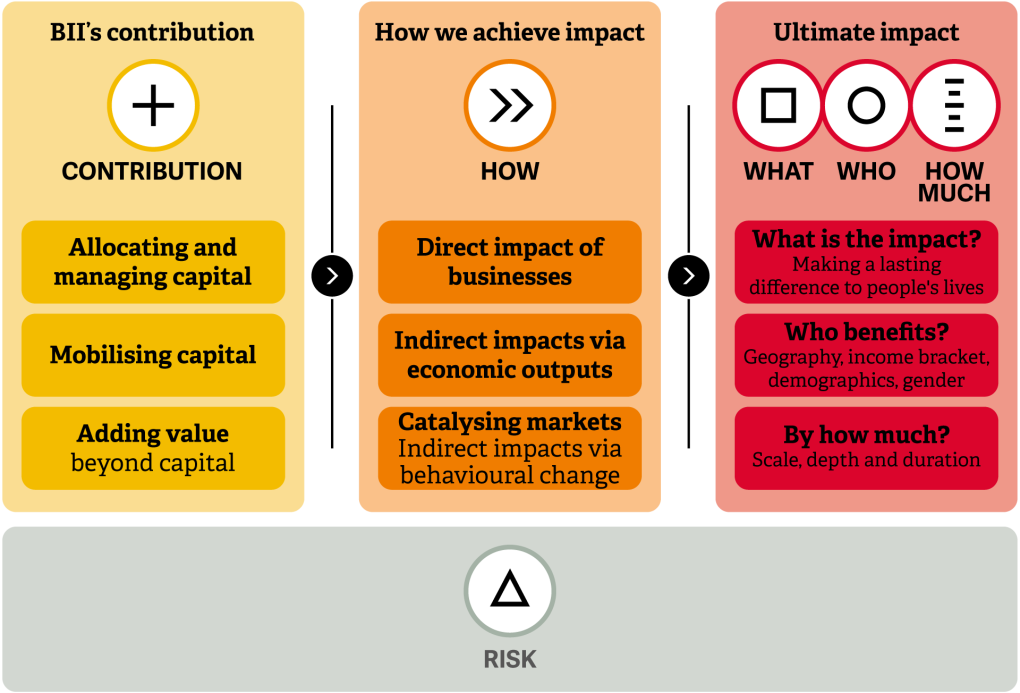

At the centre of our approach is our Impact Framework. It’s our consistent way to articulate impact, and it provides a lens to assess expected impact, and monitor it over time. It measures six ways our investments deliver impact (How, What, Who, How much, Contribution, and Risk), and aligns with the Impact Management Project’s dimensions of impact – which have achieved industry consensus.

How do we assess the potential impact of each investment?

For each potential investment, we translate our Impact Framework into an ‘Impact Dashboard’. It defines what we expect to achieve through an investment and involves assessing the impact against the six dimensions of impact, as well as linking the impact of the investment to the Sustainable Development Goals. This work is complemented by impact frameworks we’ve developed for each priority sector we invest in.

Within each Dashboard is an assessment of our contribution, which examines the difference our capital makes to an investment. It ensures we are supporting impact that could not be achieved without us, and not displacing commercial investors.

We carefully consider the Impact Dashboard when deciding whether to invest.

How do we know if we are achieving our impact objectives?

To complement our detailed assessments of individual investments, we use a tool to help us manage our performance against our strategic impact objectives. It’s called the Impact Score, and is designed to incentivise investments that support our productive, sustainable and inclusive objectives.

Every potential investment is given a score against each of these three objectives, based on some of the factors we consider in the Impact Dashboard. An overall investment score is then calculated. The higher the score, the greater the alignment with our objectives.

Individual scores are combined to create an aggregate impact score for our portfolio, which we report on publicly.

How do we monitor ongoing impact?

We take the monitoring of impact very seriously. We regularly review each investment’s performance against its Impact Dashboard and update its Impact Score based on our monitoring. We also carry out ongoing evaluation of our investee companies, to understand whether we’re meeting our initial impact aims and where we can add more value

We know that building resilient businesses with strong environmental, social and governance practices is core to long-term growth and economic development. We invest responsibly, ensuring that our investees comply with our Policy on Responsible Investing, and supporting them to enhance their environmental, social and governance practices.

We are an active investor, looking to add value to maximise the development impact of our portfolio. We can provide additional expertise and resources on a case-by-case basis to help investees increase their commercial performance and development impact, with a focus on our priorities of gender, diversity and inclusion and climate change. We also manage a technical assistance facility, called BII Plus, that can be allocated to pipeline and portfolio companies, to add value.

When we exit an investment, we consider both the financial and impact implications, including how impact will be sustained after we have left.

For each investment, we require that our investees report on key monitoring indicators each year. This provides us with a consistent approach to establish and manage our portfolio impact. It includes a range of metrics aligned to our strategic objectives, such as how many jobs our portfolio supported, the local taxes contributed to governments, the amount of third-party capital we mobilise, as well as certain metrics for our priority sectors. We have also signed up to the Task Force on Climate-Related Financial Disclosures and we disclose annually the progress we are making against our Climate Change Strategy by tracking several portfolio climate metrics, for example, our portfolio carbon footprint. These metrics are collected and trends analysed to monitor the overall portfolio impact, and then reported in our Annual Review.